What is embedded finance?

Embedded finance allows non-financial businesses to integrate financial services into their own products, without the need for any licensing or high-level developer input.

Increasing Competition Between Banks and Mobile Money Companies

Fintech, or financial technology, is disrupting the financial industry in many ways, and one of the most significant developments is the rise of mobile money. Mobile money services allow users to store and transfer money using their mobile phones, without the need for a bank account. This has made financial services more accessible to people in developing countries, where traditional banking infrastructure is often limited. Banks and mobile money companies are now competing for the same customers. Banks have the

Tokenized Shares: The Fintech Decree 2023

The tokenization of investments and properties is one of the many blockchain applications that are proving to be currently active and profitable. This includes managing exchange services and creating cryptocurrency-related assets and derivatives. Generating tokens enables the creation of a scarce, highly liquid, and programmable asset, linked to various sources of value. Initial Token Offerings (ITO) involve creating value linked to a token issued on an existing blockchain, such as Ethereum. This type of activity is usually linked to a

Generative artificial intelligence is poised to revolutionize finance

Bloomberg has unveiled a new generative artificial intelligence model that leverages machine learning to perform tasks in the financial industry. The platform, called BloombergGPT, has been trained on a large set of financial data based on Bloomberg’s proprietary data sources. The goal of BloombergGPT is to assist users in researching and understanding data by providing support for analysis, news classification, and answering questions. Exclusive access to financial data gives Bloomberg an advantage over its competitors and could position it as

Crowdfunding: What changes with Legislative Decree No. 30 of March 10

Italy, after a two-year wait, has also implemented the European crowdfunding regulation to provide greater protection for investors and greater transparency for crowdfunding platforms. Crowdfunding regulation is an important issue in promoting the financing of start-ups and SMEs, and this new legislative decree should help promote a safer and more reliable investment environment for Italian consumers. Legislative Decree No. 30 of March 10, 2023 implements Regulation (EU) 2020/1503 on European crowdfunding service providers for businesses and amends Regulation (EU) 2017/1129

Fintech: what is it, what does it do, and what are the advantages?

Fintech is the contraction of the words ‘finance’ and ‘technology.’ The term, known in Italian as tecnofinanza or tecnologia finanziaria, refers to the sector of the financial industry that offers its services through new digital technologies. Technological innovation makes financial innovation possible, which can translate into new business models, processes, or products, as well as new market players. The use of technology is a necessary element to enable financial innovation. Fintech is not limited to the banking sector alone, but

Pandemic Covid-19 and Fintech: innovation is always the key

The COVID-19 pandemic has accelerated the adoption of fintech solutions due to the increased demand for digital financial services and remote transactions. The pandemic forced people to rely on digital solutions for everything, including financial services. As a result, fintech companies have seen a significant increase in demand and many traditional financial institutions have also begun adopting fintech solutions to stay competitive. The pandemic has also highlighted the importance of financial inclusion, and fintech has the potential to reach disadvantaged

The Italian Fintech Ecosystem – Report Fintech Waves

The data emerging from the second edition of the Fintech Waves report, produced by EY – in collaboration with the Fintech District – provide an insight into the evolution of the fintech landscape in Italy. Over 100 industry operators – lending, techfin, crypto, DeFi, neobanks, payments, crowdfunding, etc. – have responded to the questions, offering a representative picture of fintech in Italy. In Italy, from 2016 to today, the funds raised have grown at a compound annual growth rate (CAGR)

The benefits of integrated finance for companies

Integrated or embedded finance refers to the integration of financial services within the websites, mobile apps, and business processes of non-financial companies. The theory behind it is that consumers are more likely to use and purchase financial products or services if offered by their trusted brands. The new report, commissioned by Bond, “The Embedded Finance Flywheel” by Cornerstone Advisors, provides insight into the intentions of brand-loyal consumers. Each sector investigated offers opportunities for integration and growth, confirming an upward trend:

Scenari Immobiliari Report – 2023 Forecasts Real Estate

The 30th Scenari Immobiliari Forum was held in Santa Margherita Ligure, Italy on September 16th and 17th, 2022[1]. The theme of the forum was “The Future is Now”[2][4], with the goal of providing operational recommendations to help define business strategies and facilitate communication among stakeholders[3]. The forum provided an overview of what might be in store in the short and long term for the Italian real estate market.[2] The forum focused on topics such as the current state of the real

Top 10 app Ideas for 2023 – The Future of FinTech

The financial sector is undergoing a significant transformation due to the rising adoption of FinTech. FinTech, which is the combination of finance and technology, has brought about modern reforms in customer priorities, making monetary transactions quick and secure. Popular FinTech apps have gained immense popularity in recent years, with industrial experts claiming that “FinTech is the future.” The FinTech industry has seen enormous growth and has proven to be one of the most promising sectors. In 2021, FinTech funding recorded

The Evolution and the future of Embedded Finance by Finch Capital

According to Radboud Vlaar, Managing Partner at Finch Capital, the embedded finance industry will become one of the most value creative sectors in fintech, reaching a value of $7 trillion globally over the next ten years. The financial services industry is experiencing a rapid transformation as technology continues to play a larger role in how banks and other financial institutions operate. The proliferation of APIs and the platformification of businesses is at the forefront of this evolution, with banks becoming

What Is Embedded Finance?

The inescapable technology enables faster and more convenient access to financial services. Embedded finance is a new approach to financial services that seeks to integrate financial functionality into everyday products and services, rather than having consumers seek out financial services on a standalone basis. This approach is also called “finance-as-a-service” or “banking-as-a-service“ as it is acting as a API or SDK that other businesses could utilize in their platform, providing access to financial services to their own customer base. Embedded

The Embedded Finance Journey: the view of Goldman Sachs

To better understand the rise of Banking as a Service (BaaS) and its evolution towards more advanced implementations that can seamlessly integrate financial services into various business activities, it is helpful to consider the typical pattern of business growth. As a company grows and establishes a stable customer base, it may look for ways to diversify its offerings and monetize its customer relationships. One way to do this is by investing in new capabilities or partnering with other companies. The

Creating a seamless future for financial services by Rise FinTech Insights Barclays

The growth of Embedded Finance reflects the predictions of FinTech investor Eileen Burbidge, who anticipates that innovation and digital strategy will become integral to an organization’s core business strategy and that FinTechs will shift from B2C to B2B models. Key to the success of Embedded Finance will be the use of technology, such as APIs and the cloud, which allow for the reformation and co-development of financial services with third-party companies. If the financial industry and FinTech community can embrace

Embedded Finance: Partnering for success (KPMG)

The use of cloud computing and artificial intelligence (AI) has enabled fintechs to offer innovative and disruptive business models that have the potential to shake up the traditional financial industry. This, combined with the growing adoption of BaaS solutions, has led to the growth of the embedded finance industry, which is expected – according to KPMG – to reach $230 billion by 2025. The embedded finance industry has seen significant growth in the past few years, with the integration of

Embedded finance: A McKinsey & Company report

Embedded finance, a concept that involves integrating financial services into everyday products and services, is gaining traction in the financial industry. This trend is driven by consumers’ increasing demand for seamless and convenient access to financial services, as well as the growing number of fintechs and technology companies offering financial products and services. As embedded finance becomes more prevalent, it is likely to reshape the financial landscape, with the potential to disrupt traditional financial institutions and change the way financial

Banking as a Service, Explained: the Deloitte report

According to Deloitte, Banking as a Service (BaaS) is reconfiguring the banking value chain, opening the door to disintermediation and enabling new sources of growth. The latest Deloitte report, “Banking as a Service, Explained,” can help you understand what BaaS is, why it’s important, and how to play. Traditionally, banks have relied on a one-size-fits-all approach to provide services to customers, which can be limiting and inflexible. BaaS allows non-financial companies, such as fintech startups and retailers, to offer customized

The growth of the embedded finance: the view of Bain & Company

According to Bain & Company, the rise of embedded finance marks a new era, not only for banking transactions but also for how consumers and businesses build and manage relationships with financial services more broadly. Some businesses starting up today may not interact with traditional financial institutions such as banks. Rather, they can log in to their accounting or e-commerce platform and meet most of their financial needs. For example, they can open deposit counts and order debit cards with

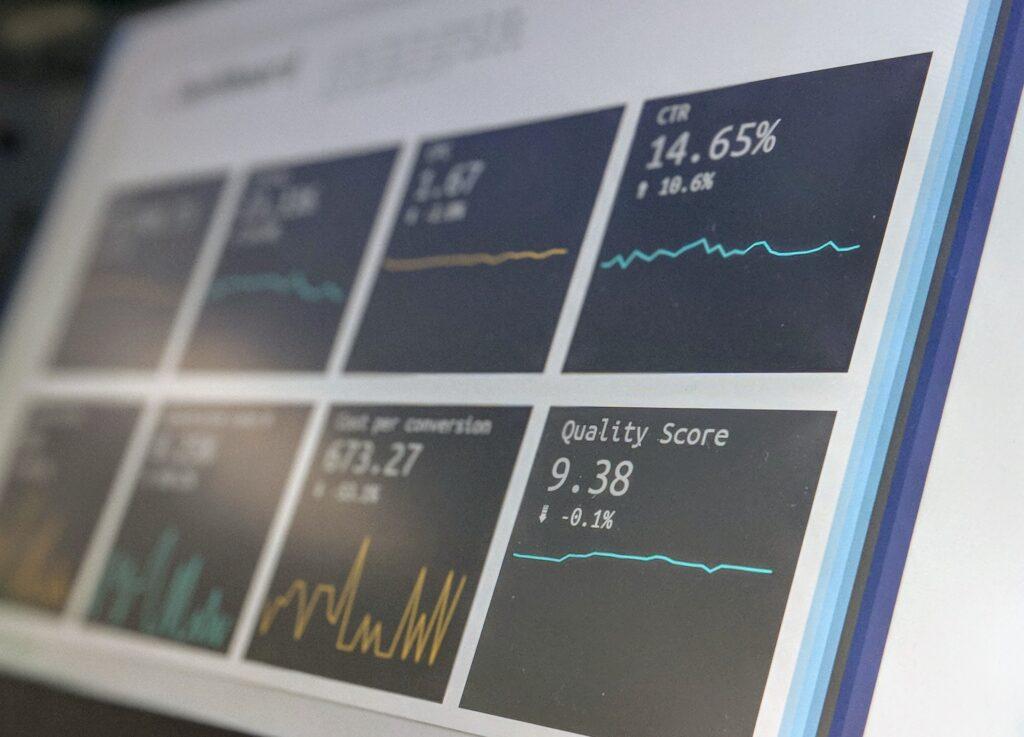

We can help you improve your numbers

We can help you improve your numbers

Companies who prioritize user experience practices can increase their Key Performance Indicators up to 83%

9,900% Return of Investment

Research from Forrester evidenced that for every dollar invested in UX, companies would obtain 100 dollars in return

What our clients say:

“We provide modular microservice solutions with the best frameworks in the market to guarantee complete scalability for your platform. Enjoy an optimized mix of SaaS API and coding that remains your property.”

“We provide modular microservice solutions with the best frameworks in the market to guarantee complete scalability for your platform. Enjoy an optimized mix of SaaS API and coding that remains your property.”

“We provide modular microservice solutions with the best frameworks in the market to guarantee complete scalability for your platform. Enjoy an optimized mix of SaaS API and coding that remains your property.”

Let’s embed finance together!

Let us know your ideas and needs and we will be in touch shortly