The data emerging from the second edition of the Fintech Waves report, produced by EY – in collaboration with the Fintech District – provide an insight into the evolution of the fintech landscape in Italy.

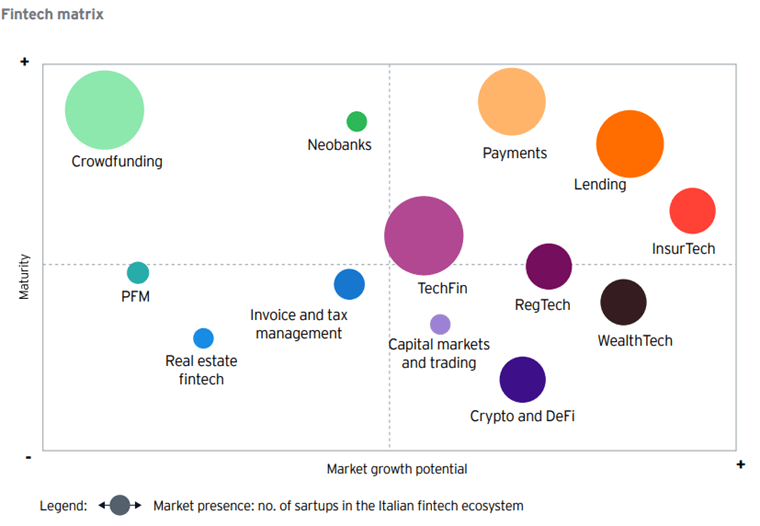

Over 100 industry operators – lending, techfin, crypto, DeFi, neobanks, payments, crowdfunding, etc. – have responded to the questions, offering a representative picture of fintech in Italy.

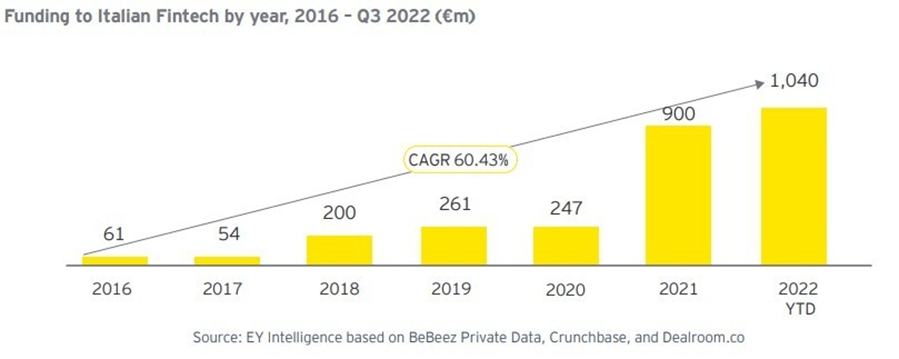

In Italy, from 2016 to today, the funds raised have grown at a compound annual growth rate (CAGR) of over 60%. In 2022, they reached 1.040 billion euros, with a significant increase from 900 million in 2021 and 247 million in 2020.

However, it should be noted that fundraising is highly concentrated, with 94% of funding going to fintechs with collections of over 100 million and annual revenues exceeding 5 million.

In 2022, the funding reached 1.040 billion euros, with a significant increase from 900 million in 2021 and 247 million in 2020.

From the survey, it emerged that the payments sector has collected the most funds, followed by neobanks. Early Growth phase fintechs have increased by 37%, while those in the Early Stage phase have decreased by 25%, indicating growth and evolution of the Italian ecosystem. 24% of the fintechs interviewed have a revenue of over 5 million euros and represent 97% of the funds raised. 44% of the fintechs interviewed have a post-money valuation of over 10 million euros.

17% of those interviewed rely on international Venture Capital funds, whose role has been consolidated, while 15% rely on personal financial resources. 32% of fintech startups look to international VC operators for a desire for international expansion and business growth. M&A and IPO are the preferred exit strategies respectively for 45% and 31% of those interviewed, however, in Italy, there have been few operations of this type. 7% of the sample have no exit strategy, partly due to the current macroeconomic scenario.

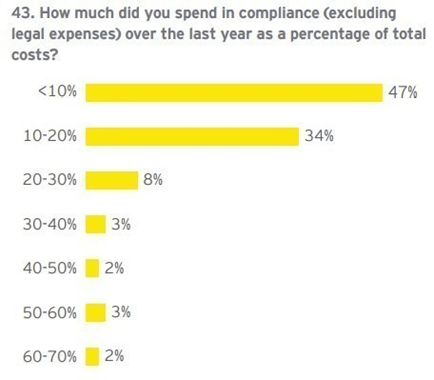

The role of compliance is critical for those in the financial industry who want to grow

87% of the fintechs interviewed by EY and the Fintech District claim to have a dedicated Risk & Compliance figure, compared to 74% in 2020. In 56% of cases, the person responsible is an internal employee, while 31% entrust this role to an external party, demonstrating an increasingly greater awareness of the importance of compliance. Furthermore, only 5% of fintechs have taken advantage of the regulatory Sandbox offered by the Bank of Italy, while 55% are not interested and the remaining 40% were unable to access it due to a lack of requirements.

People and Skills as a Growth Factor

Human capital is the key element that investors assess in a new opportunity. The average number of employees per startup is 55, but 43% of the teams consist of 1 to 10 people, while only 12% have 100 to 800 employees. 86% of the teams have more than 50% men, however 46% have a fair level of gender diversity, with a percentage of women ranging from 30% to 50%. The average age range of team members is 27-32 years old (53%), followed by 32-40 years old (36%), confirming the young trend of Italian fintechs. The majority of teams have academic backgrounds in business and IT, while humanities backgrounds only represent 6% of the teams.

97% of fintechs plan to hire new resources in the next 12-24 months, with the most in-demand profiles in software/app development (68%) and business development (42%). 61% of Italian fintechs believe there is a shortage of talented people with specific skills, with software/app developers being the hardest to find (55%), followed by machine learning experts and data analysts (38% and 31%).

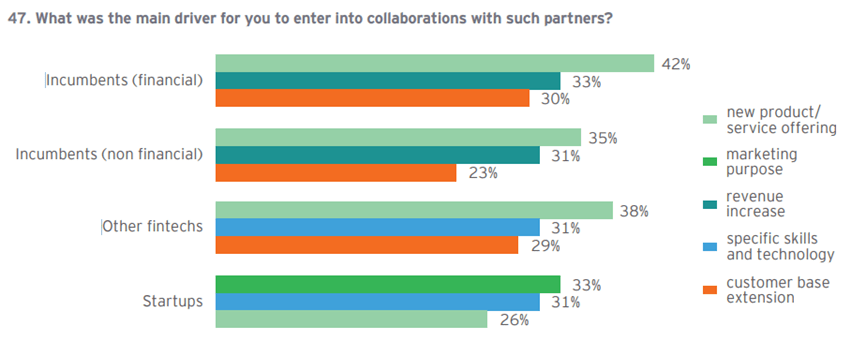

Open Innovation e collaboration

In the financial services sector, 90% of fintech startups have started collaborating with other players since 2021, with the primary goal of developing new products and services. 65% of the companies have collaborated with a bank or insurance company, 58% with other fintechs, 41% with non-financial startups, and only 25% with incumbent players from other industries. Despite the difficulties related to the integration of processes and technologies or contractual negotiations, the level of satisfaction for the collaborations is relatively high, with an average score of 7.5 out of 10.

A look at the future of fintech

The future of the financial sector will be influenced by global trends such as embedded finance, fintech “for good”, evolution of the crypto & DeFi world, innovative payments, open finance, and partnerships. These trends are related to the most mature and promising segments of the industry, identified by the analysis of EY in collaboration with the Fintech District: insurtech, lending, and payments.