To better understand the rise of Banking as a Service (BaaS) and its evolution towards more advanced implementations that can seamlessly integrate financial services into various business activities, it is helpful to consider the typical pattern of business growth.

As a company grows and establishes a stable customer base, it may look for ways to diversify its offerings and monetize its customer relationships. One way to do this is by investing in new capabilities or partnering with other companies. The latter option may be especially appealing when the required outlay to develop the necessary capabilities independently is high. This is the case for embedded financial services, which require significant expertise and technology investments to manage regulatory, legal, and compliance issues, as well as to operate at scale.

Given the cost and complexity involved in offering financial services independently, it is not surprising that many businesses opt to partner with banking providers instead. This trend is driven by the increasing demand for financial interactions beyond simple sales transactions, as well as the structural barriers to entry in the financial services industry. As a result, the Banking as a Service (BaaS) model has gained popularity, allowing businesses in various sectors to expand their financial offerings through partnerships with banking providers.

FinTech’s role in Embedded Finance

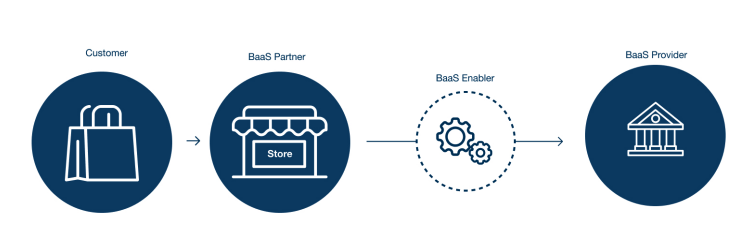

There are several key players in the BaaS ecosystem.

- The customer is the end user of the financial products offered through the BaaS system.

- The BaaS partner is the company that integrates the financial services into its own technology systems.

- The BaaS provider is the company that operates the financial services and makes them available to the BaaS partner through APIs.

- The BaaS enabler, which are companies that facilitate or simplify the integration of the BaaS services. These enablers can be divided into two categories: those that make it easy to interact with a large collection of APIs, and those that provide infrastructure to expose APIs on top of an existing platform.

The fundamental structure of embedded finance can be understood with the customer as the end user, the BaaS partner in the middle, and the BaaS provider as the underlying operator of the services.

Properly implemented BaaS solutions are beneficial for all parties involved. They remove friction and elevate the customer experience, leading to improved customer retention and increased revenues. BaaS solutions may vary, but they all share the principle of seamlessly integrating financial services to improve the customer experience.

Source: The Embedded Finance Journey: Innovation That Differentiates the Customer Experience – Goldman Sachs

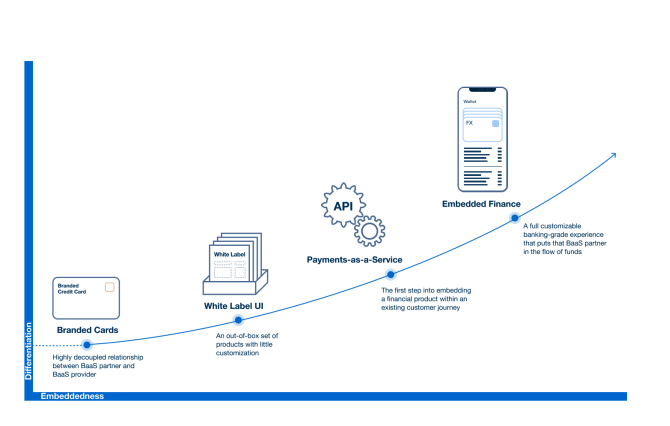

Levels of embeddedness

Cloud computing and APIs are important technology that are central to BaaS. One key aspect to consider as BaaS offerings continue to develop is the level of integration of financial products into the customer experience. The degree of embeddedness will impact the ability to differentiate the financial products that the customer encounters, which is becoming an important factor for BaaS partners, particularly those who are large technology companies with a focus on providing a top-notch online customer experience. In order to achieve differentiation, BaaS partners must be able to seamlessly integrate financial products into the customer journey, which requires a BaaS provider that can offer fine-grained APIs with bespoke behaviors. This can be technically challenging and requires a flexible platform as well as strong collaboration between the BaaS provider and BaaS partner. To completely own the customer journey, the BaaS partner must be willing to integrate the financial product into the customer experience in a way that allows for a smooth transition between services owned and operated by the provider.

Source: The Embedded Finance Journey: Innovation That Differentiates the Customer Experience – Goldman Sachs