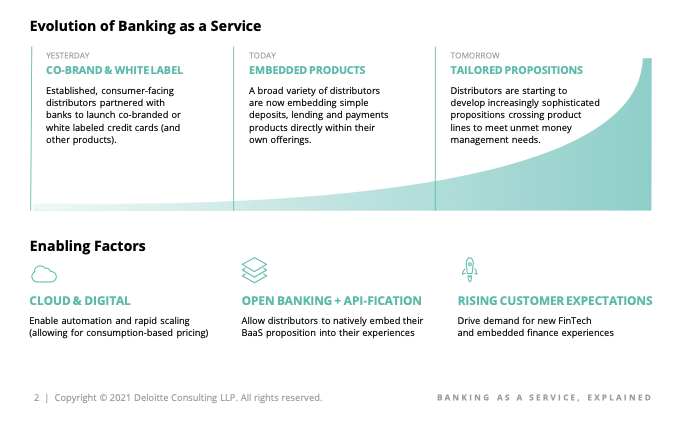

According to Deloitte, Banking as a Service (BaaS) is reconfiguring the banking value chain, opening the door to disintermediation and enabling new sources of growth. The latest Deloitte report, “Banking as a Service, Explained,” can help you understand what BaaS is, why it’s important, and how to play.

Traditionally, banks have relied on a one-size-fits-all approach to provide services to customers, which can be limiting and inflexible. BaaS allows non-financial companies, such as fintech startups and retailers, to offer customized banking services to their customers without having to invest in their own infrastructure and technology. This not only enhances the customer experience but also allows these companies to offer competitive services and generate new revenue streams.

BaaS also enables banks to expand their customer base and offer new services without incurring significant costs. For example, a small regional bank can leverage the infrastructure of a larger bank to offer services such as mobile banking and online payments, which may not have been feasible for them to offer on their own.

One of the key advantages of BaaS is its flexibility and scalability. Companies can choose the specific services they want to offer, and easily scale up or down based on their needs. This is particularly useful for fintech startups and small businesses, who can offer customized services to their customers without incurring significant costs.

Another advantage of BaaS is its ability to provide enhanced security and compliance. Financial institutions are subject to strict regulations, and BaaS providers have the necessary expertise and technology to ensure compliance with these regulations. This not only protects the interests of customers but also provides peace of mind to the companies offering the services.

Banking as a Service (BaaS) refers to the practice of non-financial companies offering financial services to customers, such as loans and payment processing, through the use of white-label banking solutions.

BaaS also provides opportunities for innovation and collaboration. By leveraging the infrastructure and expertise of third-party providers, companies can focus on developing innovative products and services without having to worry about the underlying technology and compliance. This creates a conducive environment for collaboration and partnerships between banks, fintech companies, and other non-financial companies.

In conclusion, Banking as a Service offers a range of benefits for both customers and companies. It enables non-financial companies to offer customized banking services to their customers, and allows banks to expand their customer base and offer new services without incurring significant costs. BaaS also provides enhanced security and compliance, and creates opportunities for innovation and collaboration. As the financial industry continues to evolve, BaaS is likely to play a significant role in shaping the future of banking.

For full Deloitte report see: https://www2.deloitte.com/cn/en/pages/financial-services/articles/importance-of-banking-as-a-service.html