According to Bain & Company, the rise of embedded finance marks a new era, not only for banking transactions but also for how consumers and businesses build and manage relationships with financial services more broadly.

Some businesses starting up today may not interact with traditional financial institutions such as banks. Rather, they can log in to their accounting or e-commerce platform and meet most of their financial needs. For example, they can open deposit counts and order debit cards with these platforms. Institutions behind these platforms are not usually banks. Instead, they are software companies that collaborate with financial institutions and tech providers to embed financial services and products into the customer user experience. These products are usually seamless, convenient, and easy to use.

This new partnership between financial institutions (banks and financial product distributors) and tech farms through nonfinancial platforms is the driving force behind the embedded-finance revolution. The rise of this novel product marks a new era for banking transactions. Additionally, embedded finance is transforming the experience of customers and businesses with financial services in a broader sense.

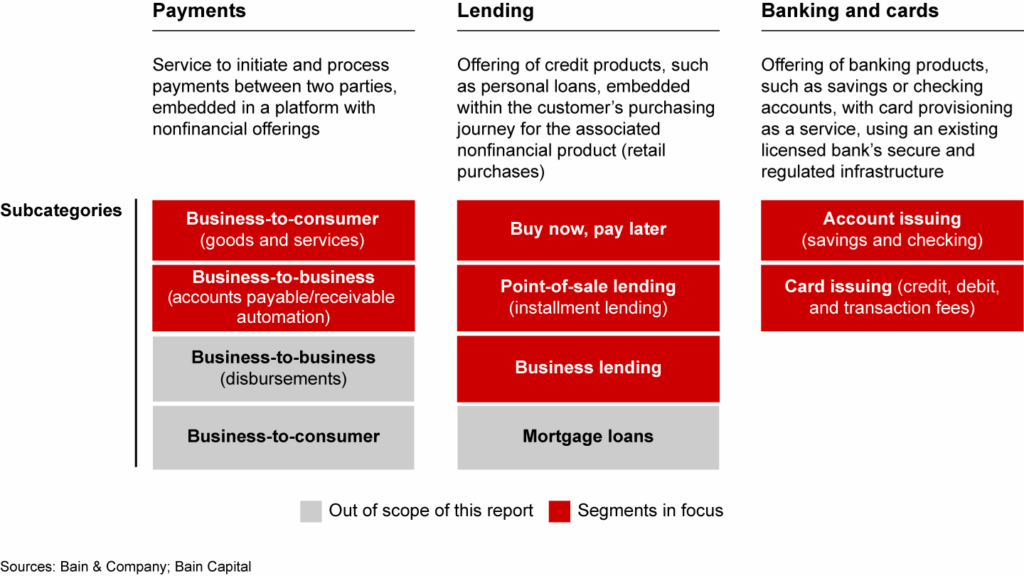

The value of this integrated customer experience explains the rapid growth in the market size of embedded finance. A report by Bain & Company estimating the growth of US embedded finance focusing on three main areas – payment, lending, and banking.

The market will more than double from $22 billion in 2021 revenue to $51 billion in 2026. The growth translates to a 19% compound annual growth rate.

In 2021, embedded finance reached $2.6 trillion, translating to about 5% of the United States’ financial transactions. A 2026 projection estimates the market size at more than $7 trillion, equaling 10% of the US financial transactions. This growth is a result of an increase in demand for embedded finance. The proposition promises improved customer experience and financial access. Other benefits include cost-reduction and risk-reduction to companies across the value chain.

The substantial increase in transaction value through embedded finance platforms will primarily cause revenue growth. The report also predicts embedded finance to penetrate several industries and smaller sub-segments such as business-to-business (B2B) payments and buy-now-pay-later (BNPL).

In 2021, embedded payment transactions reached $1.7 trillion, generating $12 billion in net revenue. This value is projected to rise to $3.5 trillion by 2026.

- Bain & Company -

Embedded finance implementation

Platforms are collaborating across the new value chain to implement embedded finance and deliver benefits to their customers. In turn, these platforms enjoy increased sales in their businesses and reduced costs.

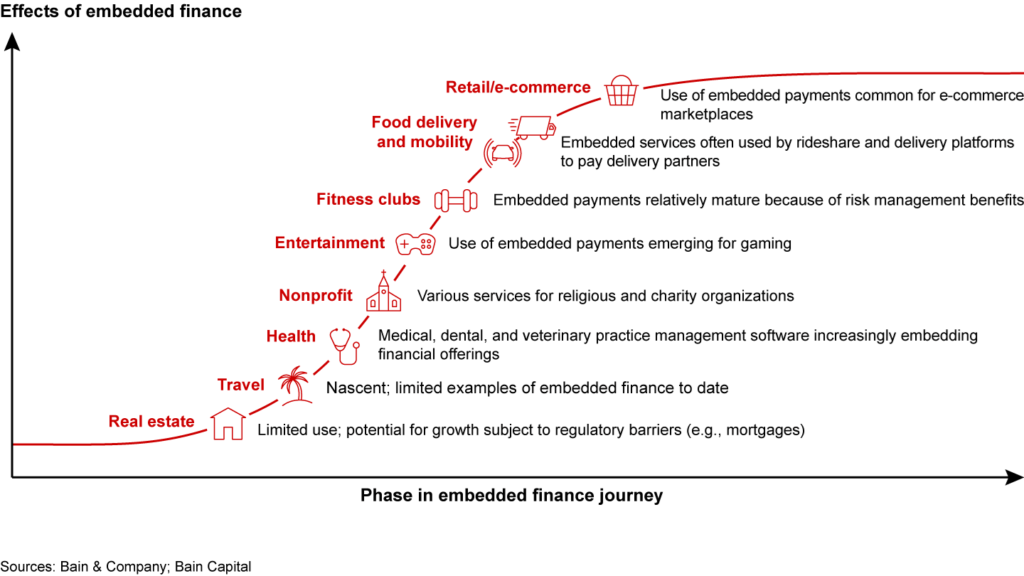

Platforms implementing the concept of embedded finance range from e-commerce, wellness, food delivery, and rideshare apps. Consequently, end users increasingly prefer the convenience of accessing various financial products on their day-to-day software rather than banks and other standalone traditional financial institutions.

Payments and debts are leading the adoption of embedded finance. However, enables will move beyond these areas into new-value added services such as insurance, tax, and payroll. The proposition could also penetrate regulation technology and compliance functionality. Some industries may be slower to advance with embedded finance. Factors that may cause the difference in the adoption rate include regulatory influences, disintermediation, and customer preference.

Who benefits the most?

Platforms will continue to serve as the prime owner of the customer relationship. Therefore, they will have more bargaining power than the enablers. They will benefit more from the embedded finance profit pool. The exception could be large enablers capable of commanding a large share of economic rents.

Some large platforms may bring in-house enabling services, to minimize expenditure. These could include credit and market risk functions.

Embedded finance and traditional banking

Embedded finance is also disrupting the traditional banking value chain. While banks traditionally provide services across the entire value chain, implementing embedded finance will unbundle this business model.

Traditional banking institutions should leverage embedded finance to reinvent their core business. They can build new growth engines and provide more interoperable products and services.

Embedded finance can provide a much better value proposition. Customers benefit from contextual, seamless experiences; platforms can unlock new use cases and often use proprietary customer data to improve financial access, while reducing costs for their end customers. .

- Bain & Company -

What is the next step for the value chain, enablers, and platforms?

Embedded finance is proving a cutting edge in the highly competitive banking sector. Institutions that are already struggling with technological advancements may find it more challenging implementing embedded finance. However, they can go around these hurdles by remaining practical and clear about monetizing their strategies. They should ensure that their moves are economically viable.

The growth may look stronger for enablers overall. However, competition may set in once the supply of new enablers exceeds demand. Providing a full suite of services, including compliance, origination, and regulatory oversight may have an upper hand. They can also gain a competitive advantage by providing easy integration and great servicing.

Platforms sets to gain hugely from embedded finance. They can maximize retention and unlock new revenue streams for lower costs by offering convenience to end users. However, they may require a careful selection of partners that can meet their needs.

Moving Forward

Embedded finance will continue enjoying the fast-paced development arc. Its benefits to businesses enable, consumers will be driving its growth. Venture capital and growth equity will continue pumping more significant funding.

This new product will shift consumers’ interaction with their finances. The number of enablers will grow to give platforms plenty of choices when looking for the right partner. Consequently, customers will continue to enjoy improved services.

For full Bain & Company report see: https://www.bain.com/insights/embedded-finance