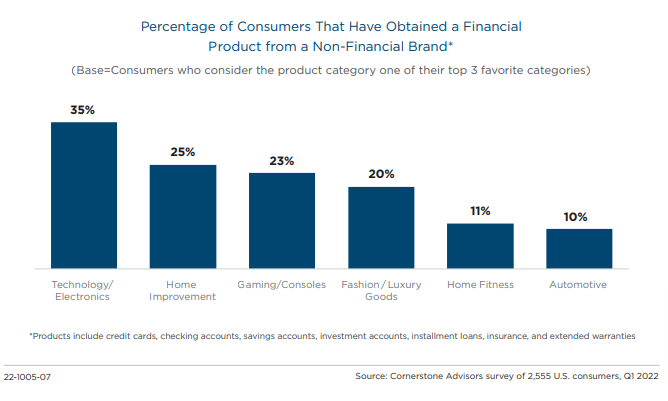

Integrated or embedded finance refers to the integration of financial services within the websites, mobile apps, and business processes of non-financial companies. The theory behind it is that consumers are more likely to use and purchase financial products or services if offered by their trusted brands.

The new report, commissioned by Bond, “The Embedded Finance Flywheel” by Cornerstone Advisors, provides insight into the intentions of brand-loyal consumers.

Each sector investigated offers opportunities for integration and growth, confirming an upward trend: embedded finance is an indispensable tool to be considered and integrated into the business strategy.

When asked “If a company you like offered the following financial products, would you be interested?” the respondents answered, in regards to the proposed service, with the interest expressed in the percentages below:

Gaming / Console

- 75% – Credit card that rewards game purchases and in-game purchases

- 74% – In-game savings account used to buy and sell virtual items in-game and collect rewards for game progress/achievements

Home Fitness

- 68% – Health insurance with rates based on your personal fitness habits, directly in their mobile app

Fashion / Luxury Goods

- 65% – Investment account integrated into the brand’s mobile app that allows you to invest in brand stocks, cryptocurrencies, and other assets

Technology / Electronics

- 62% – Checking account that allows you to deposit money, cash checks, withdraw money from ATMs, and earn rewards

- 59% – Savings account that automatically sets aside small amounts of money to help you save for important purchases

Automotive

- 59% – Auto insurance with rates based on your personal driving history and behavior, which can be managed in the mobile app

- 52% – Savings account that automatically sets aside money beyond your monthly car loan payments to save for the next car purchase

- 48% – Credit card that compensates for your carbon emissions by investing in carbon reduction (tree planting, forest protection, etc.)

Retail

- 59% – Checking account used for purchasing, cashing checks, withdrawing money from ATMs, and earning rewards

- 55% – Savings and investment account that automatically sets aside money to save for important purchases or invest in stocks

Pharmacy

- 56% – Health savings account that allows you to save money (tax-free) for qualified medical expenses (including Rx drugs)

- 54% – Ability to load and store money in their mobile app to use for purchases and receive rewards for transactions

Home / Real Estate / Renovation

- 51% – Savings account that automatically sets aside money to help you save for big home improvement projects

- 49% – Home mortgage loan that will allow you to pay for big home improvement/renovation projects, directly in the app.

Compared to Baby Boomers, a higher percentage of Gen Z, Millennials, and even Gen X are interested in obtaining financial products from non-financial brands.

Why are many consumers interested in these financial products offered by non-financial brands?

- 81% Lower cost to obtain the financial product or service offered

- 61% Trusts the Brand offering the financial product or service

- 54% Is interested in the rewards and discounts that would also be offered by the Brand.

On the other hand, why are some consumers not interested in financial products offered by non-financial brands?

- 79% Uncomfortable or difficult to manage the financial product or service offered

- 77% Would not trust to acquire the financial product or service offered

- 71% Prefers to compare the conditions before making the purchase.

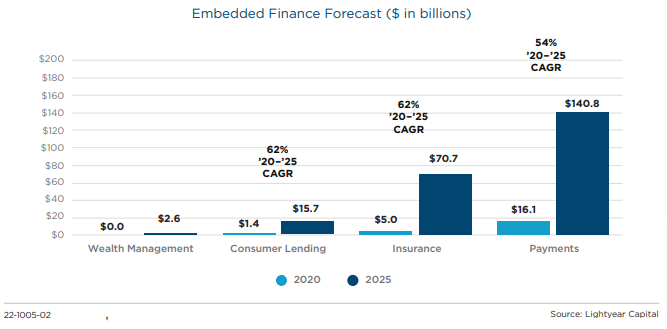

By 2025, the integrated finance sector will generate nearly $230 billion in revenue, up from the $22.5 billion in 2020. With a revenue multiple of five times, it will create more than $1 trillion in value by 2025. Lightyear Capital -

With these numbers, current and forecasted, taking advantage of the opportunity offered by embedded finance can result in a solid and concrete growth element for many sectors.

The key to the successful implementation of a financial service or product within a non-financial brand is the chosen partner. A technological partner capable of building and integrating into the technical dynamics of the brand but also into the marketing vision is certainly the most important discriminant.