According to Radboud Vlaar, Managing Partner at Finch Capital, the embedded finance industry will become one of the most value creative sectors in fintech, reaching a value of $7 trillion globally over the next ten years.

The financial services industry is experiencing a rapid transformation as technology continues to play a larger role in how banks and other financial institutions operate.

The proliferation of APIs and the platformification of businesses is at the forefront of this evolution, with banks becoming increasingly reliant on technology to remain competitive and shifting their focus to become underwriters and liquidity providers.

While Europe is still lagging behind the US in this regard, the market for embedded financial services is growing and expected to accelerate in the future due to the progression of the startup ecosystem and increased investment activity.

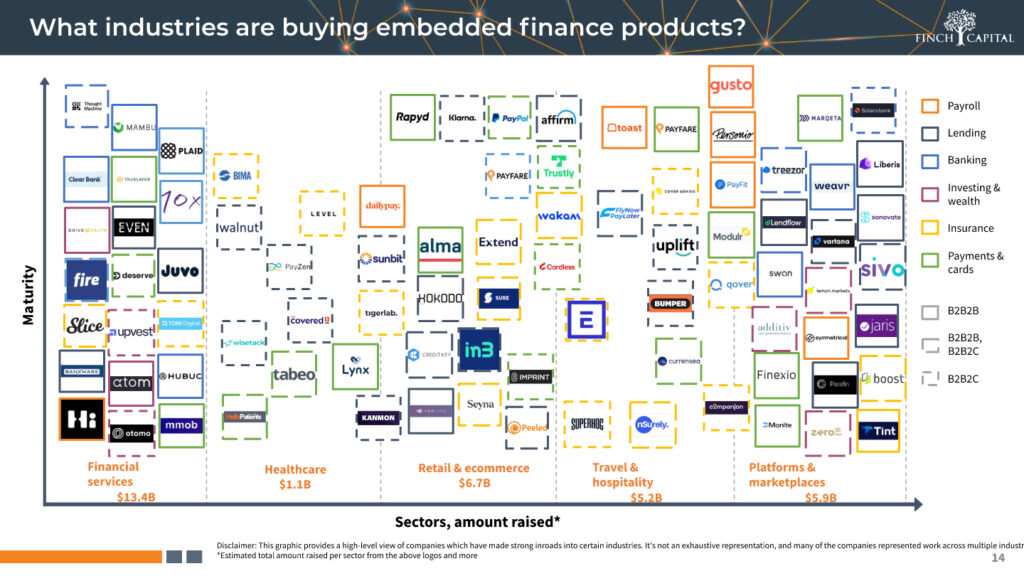

The ecommerce and retail industry have been early adopters of embedded financial services at the point of sale, including lending, insurance, and payment services.

However, other use cases are now emerging across sectors such as travel & hospitality and healthcare. Marketplaces and platforms are “rebundling” financial services to create seamless and integrated ecosystems. Both B2B2C and B2B2B business models present significant opportunities across various industries, with credit collection, embedded investing solutions, and Payroll API services being among the most promising verticals.

The current macroeconomic situation, including rising interest rates, is expected to further drive the adoption of embedded financial services, leading to an explosion of use cases across industries.

Software providers are consolidating their product offering to one-stop shops that

are tailored by vertical industries. In doing so, software platforms add financial

services to their solutions so they can accompany their clients during more (...) and get to maintain a close

relationship with them.

- Finch Capital -

What problems is embedded finance solving?

1. SMEs are struggling to obtain financial services via traditional means.

Fixed costs of providing SMEs with financial services via traditional means are high. For

instance, it costs the same to credit review a £100k turnover business as it does a £1M

turnover business.

2. Old lending models don’t work for new digital companies.

As the economy moves online, old financial models and long-winded loan application

processes are inefficient and becoming less tolerated by users. For instance, the typical

digital platform or marketplace has all the financial data required to make instant lending

decisions which can be leveraged by new embedded financial solutions.

Financial services are limited for thin file workers.

Today more than ever, consumers with low or no credit scores are in need of financial

services such as lending, payments, and banking. The old financial system is typically not

inclusive to thin file workers who suffer from high APR.

3. Data is siloed which leads to poor personalisation of products.

Traditional financial institutions are not leveraging data to personalise the user experience and

recommend relevant financial products to users at the right time in their journey.

4. Financial services are limited for thin file workers.

Today more than ever, consumers with low or no credit scores are in need of financial

services such as lending, payments, and banking. The old financial system is typically not

inclusive to thin file workers who suffer from high APR.