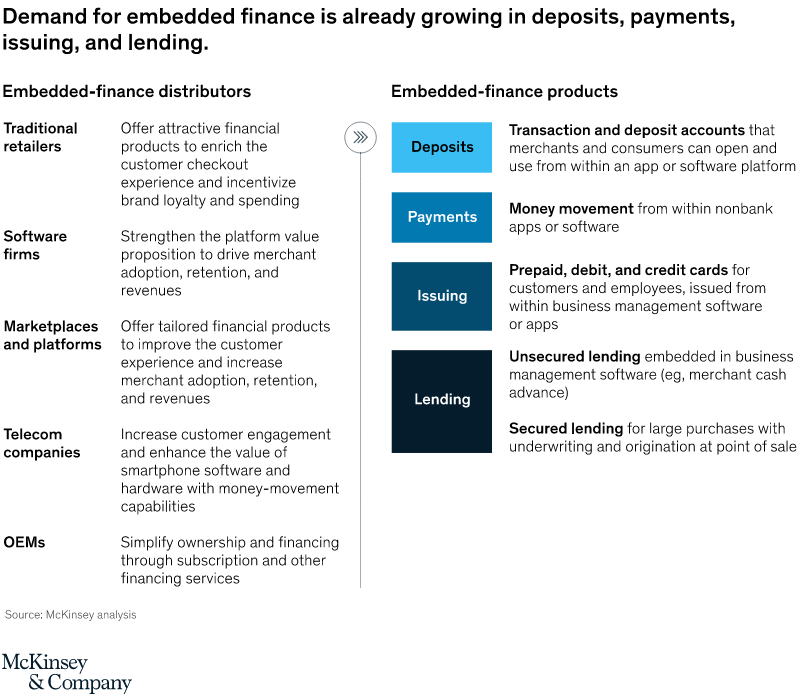

Embedded finance, a concept that involves integrating financial services into everyday products and services, is gaining traction in the financial industry. This trend is driven by consumers’ increasing demand for seamless and convenient access to financial services, as well as the growing number of fintechs and technology companies offering financial products and services.

As embedded finance becomes more prevalent, it is likely to reshape the financial landscape, with the potential to disrupt traditional financial institutions and change the way financial services are delivered and consumed. This presents both opportunities and challenges for various players in the financial ecosystem, including banks, fintechs, technology companies, and regulators.

One of the key opportunities for traditional financial institutions is the potential to deepen customer relationships by providing more comprehensive financial services. For example, banks could offer credit card services to customers who purchase goods and services from non-financial companies, such as retailers or airlines. This would enable banks to capture a larger share of customers’ financial activities and increase their revenue streams.

Fintechs and technology companies, on the other hand, are well positioned to capitalize on the trend of embedded finance. By partnering with non-financial companies, fintechs and technology companies can offer financial services to a wider audience and gain access to valuable customer data and insights. This could help them develop more personalized and targeted financial products and services, and potentially expand into new markets and segments.

The value of this integrated experience for customers helps explain why embedded finance reached $20 billion in revenues in the United States alone in 2021, according to McKinsey’s market-sizing model

Who are the enablers of embedded finance?

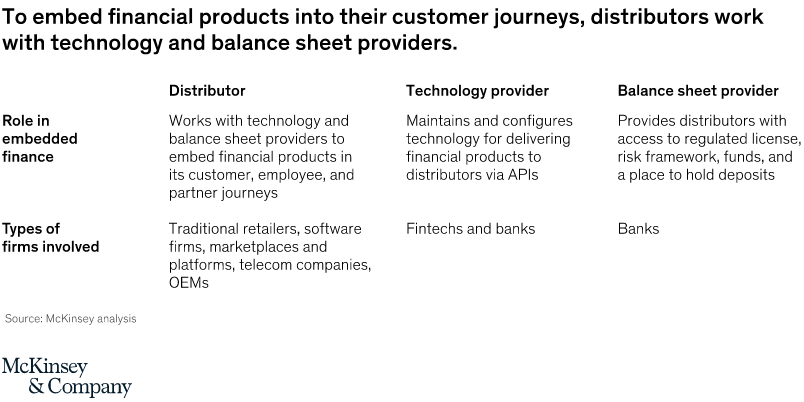

Fintech companies, also known as technology providers, offer platforms that allow distributors to access, customize, and offer financial products as part of their own products or services. These products, known as embedded finance, can include everything from card issuing to deposits, money movement, and lending.

Some technology providers, such as Marqeta, specialize in specific categories of financial products, while others, like Unit, Bond, and Alviere, offer a broader range of products on their platforms.

Licensed financial institutions, or balance sheet providers, are responsible for manufacturing these embedded finance products, providing risk and compliance services, and facilitating access to funds for lending and deposit products. In some cases, technology providers and balance sheet providers may work together to offer an integrated embedded finance solution to distributors. For example, Stripe is partnering with Goldman Sachs and other banks to provide embedded finance to platforms and third-party marketplaces.

the rise of embedded finance is set to have a significant impact on the financial industry

Regulators, however, face the challenge of ensuring that the development of embedded finance is aligned with consumer protection and financial stability objectives. They will need to establish clear and consistent guidelines for the provision of financial services within non-financial companies, and monitor the activities of these companies to ensure compliance with regulations.

Overall, the rise of embedded finance is set to have a significant impact on the financial industry. Traditional financial institutions will need to adapt to the changing landscape and explore new business models and partnerships to remain competitive. Fintechs and technology companies, on the other hand, will have the opportunity to further disrupt the financial industry and gain a foothold in the market. Regulators will need to strike a balance between fostering innovation and protecting consumers and the financial system. The players that are able to navigate these challenges and capitalize on the opportunities of embedded finance are likely to emerge as the leaders of the next payments revolution